You wouldn’t just give anyone your wallet, would you? How about someone you trust? This is the same when it comes to sharing financial details, trust is everything for financial technology (fintech).

In this Article

Before your customers decide to use your fintech services, they need to know first and foremost: Can I trust you?

Here are 9 ways you can build trust and establish that to customers:

1. Display Your Security

Does your product have end-to-end encryption? How about multi-factor authentication? What are the steps that have been implemented to prevent malicious security threats?

You may think all of this sounds too technical for the users but in fact, the users need to know all of this information. Better yet if this information can be conveyed in a way that users can easily understand.

Highlight all your security features on your website, app store and social media. A great way to display this is to create an entire section on your FAQ page, dedicate a webpage for security information or compile the top-level security features into an infographic where users have a call-to-action button they can click on to learn more.

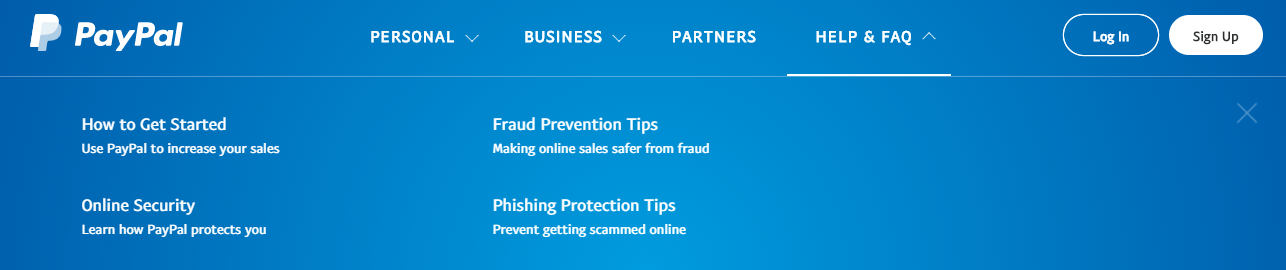

Paypal does this by dedicating an entire section under their FAQ for information about their online security, users are able to easily find this information under ‘Help & FAQ’:

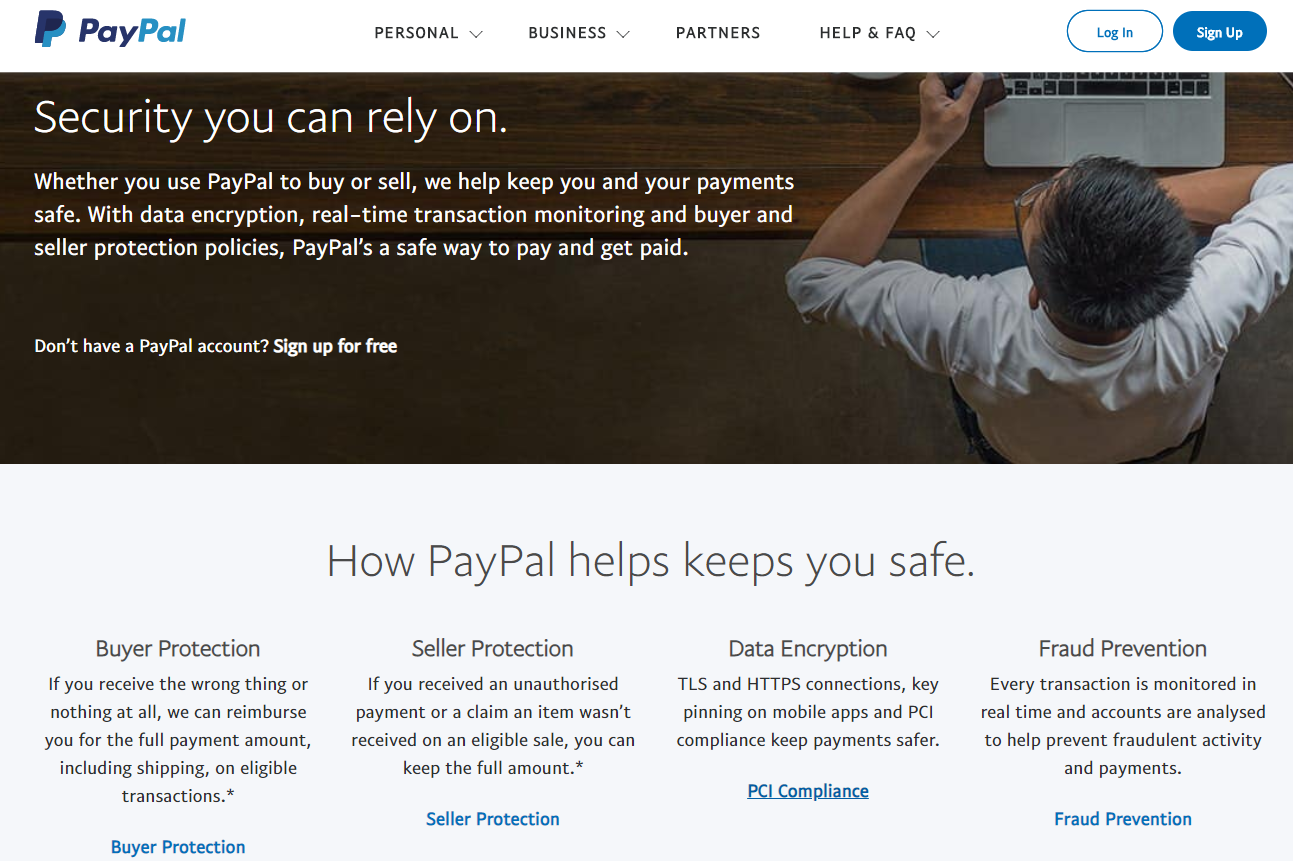

On the Security page, PayPal highlights all their security features using technical words like “data encryption, real-time transaction monitoring and buyer and seller protection policies” but at the same time, conveying it in a way that users would easily understand by breaking it down in parts and providing a link for users to click on to find out more information.

2. Be Transparent

In line with communicating your security features, it’s also important to be transparent. This means being open, and not just internally but also when you’re dealing with customers.

94% of the consumers involved in a study by Label Insight said that they are likely to be loyal to a brand that offers complete transparency. Furthermore, 73% of consumers said they would be willing to pay more for a product that offers complete transparency in all attributes.

Being transparent doesn’t mean only being open about new features, and what data you collect & how it will be used. But, more importantly, being transparent when there’s bad news. If there has been a security breach, there is an obligation to be transparent and tell your customers in handling the matter amicably.

In July 2020, there was an influx of online scams relating to BigPay where the scammers pose as personnel from BigPay to extort information from unsuspecting users in order to hack their account.

BigPay responded by practising transparency and updating their security information page accordingly to address the situation, detailing ways in which users can identify fraud and what actions to take if the user suspects there’s been a scam.

As a result, customers are made aware and are more informed on how to identify fraud in avoiding it due to the transparency provided by the company.

3. Prove Your Worth

If you want customers to choose you, it’s vital to explain how you can help them. How does your services make their life easier?

You can gain customers’ buy-in and trust by showing them exactly what your services can do for them. This is the perfect opportunity for a great show-and-tell: use demonstrations and testimonials to prove your worth.

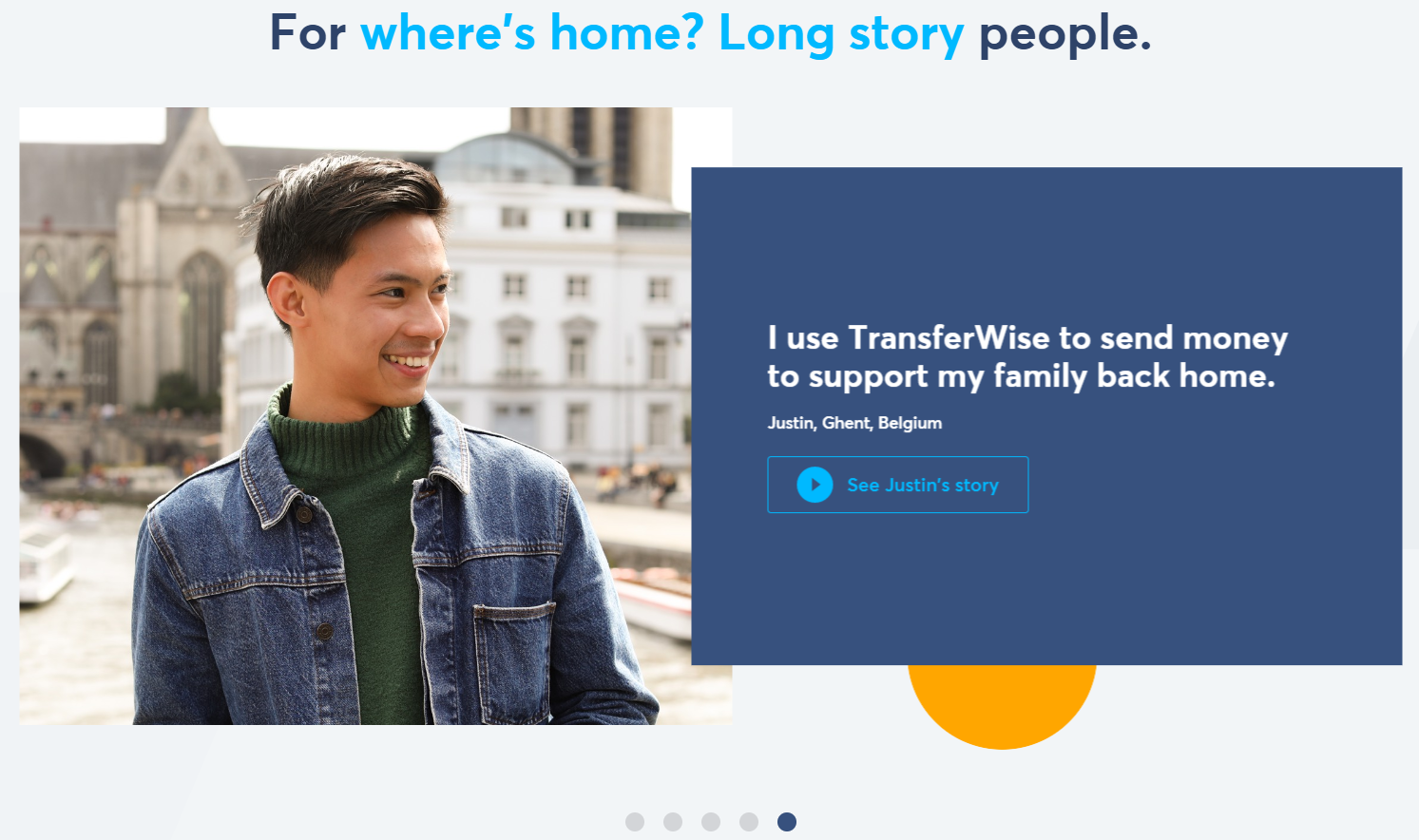

Transferwise is a good example to follow, they have a section for testimonials on the home page that features the stories of people who have used their services. They display a short statement from their featured customer, along with their picture and names. Furthermore, there’s a call-to-action for users to click on to see a short video of their story.

The short video really drives it home as a testimony, it showcases the customer’s background, the problem they faced and how Transferwise has provided an on-going solution.

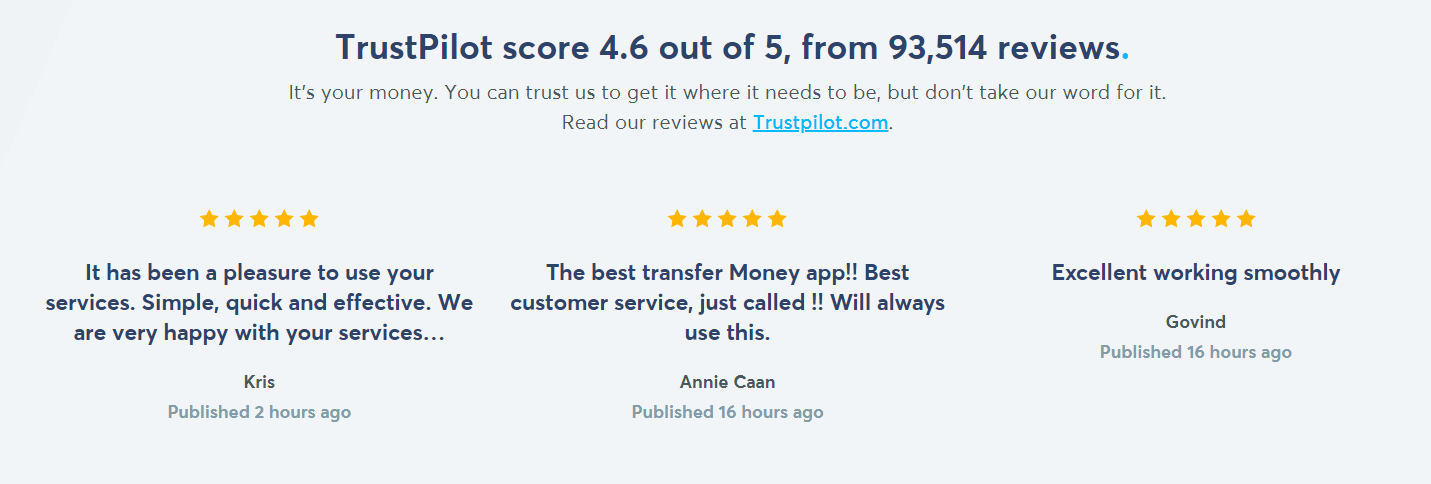

Furthermore, Transferwise also includes their TrustPilot scores and testimonies right after their highlighted testimonies.

By doing this, they are backing their testimonies with numbers, a staggering number of reviews at that. What a way to prove their worth!

4. Use Company Funds Wisely & Ethically

No one is going to trust a fintech company with their money if they can see that the company isn’t using its own money wisely. Just like how you wouldn’t give your money to that one friend that gambles his savings away.

Even if it’s not required by law, take the initiative to announce your finances, perhaps quarterly. By doing this, you are not only being transparent with your customers, but you are also showing them how the company funds are being utilised.

Money should be used wisely and ethically. Show your customers which causes your company is donating to, it’s a bonus if you provide the option for your customers to donate as well.

Boost has done this by creating a donation effort called ‘Tabung COVID-19’ where their users can donate their coins to support those affected by COVID-19. In fact, according to BERNAMA, they have raised over RM 694,843 for this donation drive alone!

5. Be Active on Social Media

Social media is now a new go-to that customers use for verification, if a business has a strong social media presence and following, it tells the user that it’s trustworthy. It’s a different form of testimonials as there’s a community that can be seen and users trust brands that make an effort to create a community.

However, quality content is required to build a community online, a good aim is to provide a mixture of text posts, images and videos. More importantly, to respond to customers who tag you and to comments, whether good or bad, especially bad comments to take action accordingly in order to improve. Remember with social media, speed is of the essence.

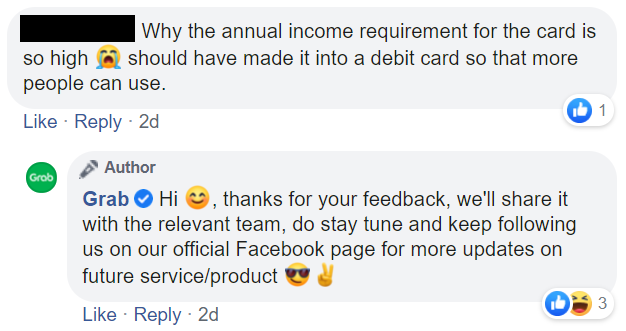

We see here how Grab has responded to a customer’s feedback swiftly on the same day related to a new Grab credit card product, providing a follow up to their comment and conveying the customer’s feedback to the relevant team in order to improve.

6. Focus on Customer Service

There is no such thing as a perfect product, even pioneering fintech services have had their fair share of bugs and problems. What defines a trustworthy company is how it chooses to respond to users’ problems.

In line with the point above to respond to bad comments and take appropriate action, it’s vital to take critique seriously. Be gracious in your response, thank the user for bringing the problem to your attention and follow up promptly after resolving the problem, bonus points if the users can be compensated for helping to bring light to these issues.

Customer service is vital, a single bad experience with a company will forever leave a bad impression on the user and anytime that company is brought up in conversation, they will have something to say about their experience.

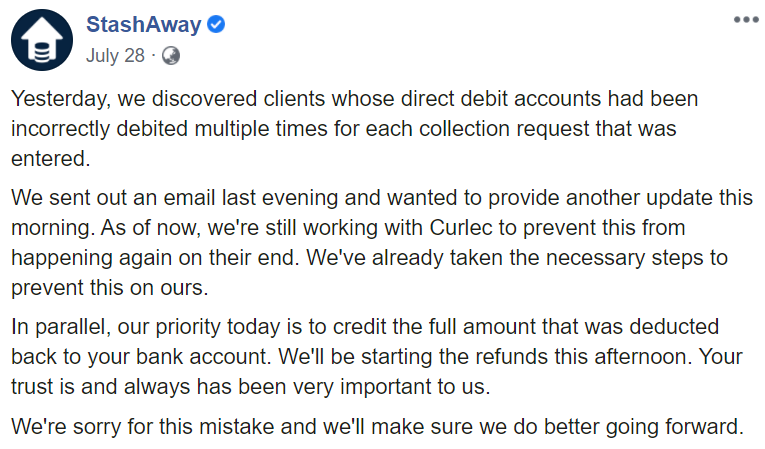

To provide an example, Stashaway had an unfortunate incident in July 2020 where a number of investors on their robo-advisory platform had found that their bank accounts were incorrectly debited up to 27 times! Despite the technical glitch of their product, the company prioritized customer service in responding to their customers and crediting all the incorrect deductions back to their customers.

The very next day, the incident has been resolved and Stashway owned up to their mistake, detailed the actions they were taking and published a public apology:

Furthermore, they practiced transparency and provided a post-mortem incident report detailing the incident for customers to read.

A great customer service experience leaves users with a good feeling and they will likely advocate for your company if they are treated well. The more responsive and proactive you are to your customers, the better.

7. Provide a Free Trial

When it comes to trust, sometimes users need to try it for themselves before buying-in. This is why free samples are such a hit, customers are able to try the product, to taste and see that it is good.

Offering a free trial is also a great way to convert skeptics. Forbes has compiled a list of fintech companies that have provided their technology for free or at a discounted price to help customers through the global pandemic, the many customers who have benefited from the free trial can then be converted into loyal customers.

8. Establish Partnerships

Another great way to build trust with customers is to build partnerships with other companies that they are already familiar with. Collaborating with trusted companies will show customers that the company that they trust in, trusts you. In turn, they would have the opinion that your company is trustworthy too.

A good way of getting partnerships established is to join in on competitions. For example, Visa partners with winning fintech startups every year, the winners get to trade on Visa’s name and benefit from the financial expertise of Visa.

9. Constantly Innovate

If there’s one thing that the fintech industry perhaps does better than any other, it’s innovation. Customers expect frequent updates from fintech companies to be pushed out to improve their services.

An excellent way of finding potential upgrades for your fintech services is to reach out to your loyal customers to find out what they want for the next improvement. This can be done through user interviews or by doing user research. It ensures that every iteration of improvement delivers value to your customers. Unnecessary and tedious updates will leave a sour taste and push customers away.

Trust is cultivated by involving customers and showing them that your company is dedicated to delivering the best to them.